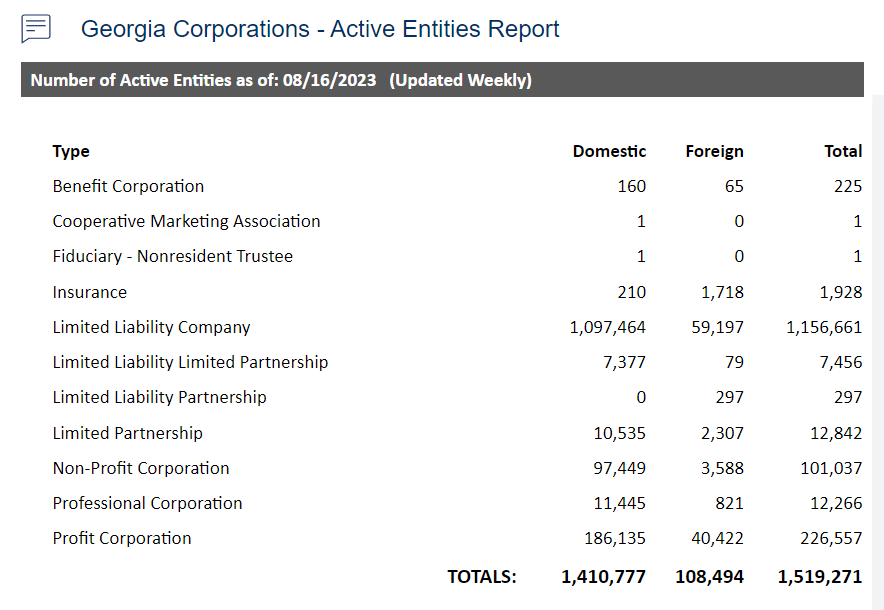

In the vibrant business landscape of Georgia, the growth trajectory has been nothing short of impressive. As revealed in the latest “Georgia Corporations – Active Entities Report,” as of August 16, 2023, the Peach State boasts a staggering 1,519,271 active entities. This not only underscores Georgia’s status as a thriving business hub but also paints a promising picture of its dynamic economic environment, beckoning entrepreneurs and investors alike.

Image Courtesy: Georgia Secretary of State

An LLC, or Limited Liability Company, is a prevalent business structure for startups and entrepreneurs, and Georgia is no exception. As with every business structure, LLCs in Georgia have their own advantages and disadvantages. This article will explore the potential pitfalls and challenges of establishing and running an LLC in the Peach State.

What is an LLC?

An LLC, or Limited Liability Company, is a business organization that protects its sponsors (limited liability protection) and benefits from pass-through taxation provisions. Like corporations, an LLC is a distinct legal body apart from its proprietors, ensuring they aren’t directly accountable for the firm’s financial obligations or liabilities.

An LLC is not subject to taxes at its own organizational level if it has multiple owners; however, it is mandated to file a tax return. The income or deficit reflected on this return is channeled to its owner(s) or members. These members are then tasked with recording this income or deficit on their individual tax filings and settling any subsequent taxes.

This legal structure has become popular due to its flexibility in tax treatment and ease of management. However, not everything is rosy. Let’s examine the challenges that accompany this business model in Georgia.

Disadvantages of an LLC Formation in Georgia

While forming an LLC (Limited Liability Company) in Georgia offers numerous advantages, such as flexibility in operations and protection of personal assets, it’s not devoid of challenges. As entrepreneurs contemplate the ideal structure for their venture, understanding the potential drawbacks of an LLC in Georgia is pivotal. This section delves into those disadvantages, providing a comprehensive overview to assist in making informed business decisions.

Complexity

In the state of Georgia, forming an LLC is a more intricate process than establishing a sole proprietorship or general partnership. While sole proprietorships and general partnerships come into existence as soon as an individual or partners start a business, respectively, an LLC requires a more formal initiation process. This involves filing the Articles of Organization with the Georgia Secretary of State and paying the associated fee. The Articles of Organization serve as the foundational document for the LLC, specifying key details like the name of the business, its principal office address, and the designated registered agent.

While not mandatory, it’s highly recommended for a Georgia Limited Liability Company to draft and maintain an Operating Agreement. This document lays out the internal governance structure of the LLC, including member roles, profit distribution, and protocols for decision-making. In contrast, sole proprietorships and general partnerships operate without such documented frameworks unless they opt for written partnership agreements. While adding another layer of complexity, the Operating Agreement ensures that all members are on the same page and can help prevent future disputes.

An ongoing aspect amplifying an LLC’s complexity in Georgia is the requirement of annual reporting. Each year, an LLC must file an Annual Report with the state, updating any changes in business details and paying the requisite fee. On the other hand, sole proprietorships and general partnerships are free from such annual state-level reporting obligations, making their administrative burden considerably lighter. This continuous compliance, coupled with the initial setup, underscores the added intricacy of managing an LLC in Georgia compared to its simpler business counterparts.

Registration Costs of LLC

In Georgia, forming an LLC comes with certain financial considerations that potential business owners need to account for. Specifically, to establish an LLC, one needs to file the Articles of Organization with the Georgia Secretary of State, which carries a fee of $100 for the initial registration. This upfront cost starkly contrasts the zero registration fees associated with initiating a sole proprietorship or general partnership, as neither of these business models necessitates formal state registration.

Beyond the first year, the financial obligations associated with an LLC continue. Each year, an LLC must file an Annual Report for $50 to maintain its good standing with the state. Notably, this annual fee is consistent with Georgia’s charges for other formal business entities like corporations, LPs, and LLLPs. On the other hand, sole proprietorships and general partnerships are not subject to these annual state-level reporting fees, making them less financially burdensome from a registration perspective.

An LLC’s structured operation and liability protection advantages come with specific financial commitments. With an initial registration fee of $100 and recurring annual fees of $50, the LLC structure in Georgia, while offering many benefits, is undoubtedly a more expensive route when compared to the cost-free initiation and maintenance of sole proprietorships and general partnerships. Prospective business owners should therefore evaluate these costs in the broader context of their business goals and an LLC’s advantages.

Registered Agent

In Georgia, the concept of a registered agent is intrinsically linked to the formalities of business operations. This agent can be either an individual or a corporate entity, and their primary role is to act as the official receiver of crucial legal documents for a business. These documents serve as vital communication threads and encompass various legal notices such as lawsuit papers, subpoenas, and wage garnishments. In essence, the registered agent stands as the official channel, ensuring that these critical legal documents are appropriately received and then relayed to the business in a timely manner.

The requirement of having a registered agent might initially appear as just an added layer of bureaucracy, but its presence has underlying logistical benefits. One of the primary advantages is the convenience it offers to businesses. With a designated registered agent in place, businesses can have peace of mind knowing that there’s a dedicated point of contact ensuring all important legal documents are received and addressed correctly. This setup becomes especially crucial for businesses that might not have regular operating hours or those whose owners are often away, making them potentially unavailable to receive vital legal papers directly.

However, it’s essential to note that while this system offers convenience, it comes with its own set of challenges and costs, especially for LLCs. Unlike the simpler structures of sole proprietorships or general partnerships, which don’t necessitate such a setup, LLCs must have a registered agent. This requirement isn’t just an administrative one; it has financial implications. Depending on the reputation, reliability, and range of services offered, hiring an external registered agent in Georgia can cost a business between $40 and $500 annually. And it’s not only LLCs that bear this obligation. Other structured business entities like corporations, LPs, and LLLPs are also bound by the same mandate, making it a widespread practice across various business models in the state.

Ability to Raise Capital

One of the paramount considerations for any business is its capacity to attract and secure funding, and different business structures offer varying degrees of ease in this domain. For Limited Liability Companies (LLCs), the terrain of raising capital is dotted with specific challenges that corporations typically don’t face. For starters, unlike corporations, which have the flexibility to issue shares of stock as a means to raise capital, LLCs lack this tool. Instead, if an LLC wants to bring in an external investor, this individual or entity would need to be incorporated as a member of the LLC. This transition is not only procedurally cumbersome but also introduces new dynamics regarding the company’s management and profit-sharing arrangements.

Further complicating the capital-raising journey for LLCs is the perception that many external investors harbor. They often view LLCs as more volatile and risky, primarily due to their unique structure and the inherent fluidity in their operational models. Consequently, these investors tend to be more comfortable putting their money into corporations, which are perceived as more stable and conventional. The challenges don’t end there. Financial institutions, including banks, exhibit pronounced caution towards LLCs when securing business debts. Instead of lending directly to the LLC, they frequently require members of the LLC to provide personal guarantees. While this might seem a straightforward enough solution, it poses a significant drawback: it effectively nullifies the core advantage of an LLC, which is the protection of personal assets. The same issue can arise for small corporations, but the regularity with which LLC members find themselves in this predicament is notably higher.

For those in Georgia contemplating the formation of an LLC or any other business entity, the Georgia Secretary of State corporation’s website stands as a valuable resource. It offers detailed insights and guidance on the nuances of different business structures, helping entrepreneurs make informed decisions. Additionally, given the intricate nature of business registration processes, tapping into the expertise of online service providers can ensure that the registration journey is seamless and devoid of legal or procedural pitfalls. These providers, with their specialized knowledge and experience, can assist in navigating the complex terrain of business setup, ensuring that entrepreneurs can focus on what they do best: running and growing their businesses.

Tax Treatment Disadvantages

In Georgia, the tax treatment of an LLC can pose challenges depending on the type of tax classification it selects. A major consideration for LLCs is deciding between C corporation or S corporation taxation. Each choice comes with its distinct set of implications. An LLC that chooses the C corporation tax status becomes liable for the Federal Corporate Income Tax, Georgia. This means the LLC would be subjected to a tax rate of 5.75% on its taxable net income. It’s a direct financial obligation that could considerably impact the business’s bottom line, especially for companies with significant taxable income.

Shifting the focus to S corporation taxation, the taxation dynamics change. In this scenario, it’s not the LLC entity but the individual members who shoulder the tax responsibility. This translates to the tax obligations passing through the company and distributed among the members according to their ownership interests. While this might sound advantageous in circumventing the direct corporate tax, it can pose complexities in individual tax planning and potential increases in personal tax liabilities for the members.

Adding another layer to the tax intricacies for LLCs in Georgia is the Net Worth Tax. Regardless of its chosen tax classification, an LLC must be mindful of this tax if its net worth surpasses the $100,000 mark. Beyond this threshold, the LLC becomes eligible for Net Worth Tax benefits. This can further compound the financial burden, especially for growing businesses investing heavily in assets and expansion. The combination of the Corporate Income Tax, personal taxes for members under S corporation status, and potential Net Worth Tax showcase the multifaceted tax challenges LLCs can encounter in Georgia.

Top 5 Advantages of a Georgia LLC

Georgia has long been recognized as a business-friendly state, and for those considering establishing an LLC (Limited Liability Company), there are numerous advantages to doing so within its borders. Here are the top five perks of setting up your LLC in Georgia:

1. Eligibility for Georgia Enterprise Zones Benefits

Registering your company in Georgia unlocks many state-offered incentives to propel your business toward success. One such perk is the eligibility to set up in Georgia’s Enterprise Zones. Establishing your business within these zones means you can benefit from localized incentives designed to support growth.

2. Property Tax Exemptions within Enterprise Zones

One of the standout benefits of the Enterprise Zones is the inland property tax exemption. Businesses that establish themselves here can also enjoy significant exemptions in professional taxes, civil construction inspection fees, and different other statutory fees, all in line with the Enterprise Zone Status Act.

3. Access to Jobs and Corporate Tax Credits

The benefits don’t just stop at Enterprise Zones. Once registered, your Georgia LLC can tap into a range of job and corporate tax credits. These credits provide financial relief and encourage enterprises to invest and create new job opportunities.

4. The Job Tax Credit

Annual Savings per Job Created: The Job Tax Credit is particularly enticing. For every job you create, your LLC can benefit from yearly tax savings amounting to $1,750. In a state that values business growth and job creation, such credits make Georgia a particularly attractive location to establish and grow your business.

5. Mega Project and Work Opportunity Tax Credits

For businesses aiming big, the Tax Credit (Mega Project) is designed for businesses that either employ at least 1,800 new employees or invest at least $450 million in the state. Additionally, with the WOTC (Work Opportunity Tax Credit), Georgia incentivizes businesses to hire those individuals who might be facing challenges getting employment, offering tax credits starting from $1,200 to an impressive $9,600 for every qualified employee.

How Can Moton Legal Group Help?

With its seasoned team of legal experts, Moton Legal Group can assist potential and existing LLC owners in navigating the complexities of Georgia’s business landscape. From registration to compliance, and even in drafting clear operating agreements, Moton Legal Group can be your guiding star, ensuring that your LLC remains in good standing while avoiding potential pitfalls.

Final Words

Georgia stands out as a beacon of opportunity, growth, and innovation in the ever-evolving business realm. With over 1.5 million active entities, the state’s thriving ecosystem offers a testament to its favorable business conditions and forward-thinking initiatives. Georgia’s dynamic landscape presents challenges and rewards for entrepreneurs, investors, and business leaders, ensuring every venture has unparalleled support and potential for success. As we look to the future, there’s no doubt that Georgia will continue to be a focal point for business excellence and innovation. Whether you’re just starting or seeking new horizons, Peach State beckons with promise and possibility.