It’s not uncommon for vehicle owners to lend their cars to friends, family members, or even colleagues. The gesture often stems from trust, necessity, or simply goodwill. However, one prevailing concern among car owners is the repercussions if the individual borrowing the car gets involved in an accident. The legal and insurance implications can be intricate, potentially impacting both the vehicle owner’s financial well-being and interpersonal relationships.

This comprehensive guide will delve deep into such situations, uncovering the nuances associated with different scenarios. From understanding insurance liability coverage to knowing what steps to undertake post-accident, we aim to equip you with all the necessary information. This way, should you ever find yourself in such a predicament, you’ll be well-prepared to navigate it.

The Danger of Car Accidents

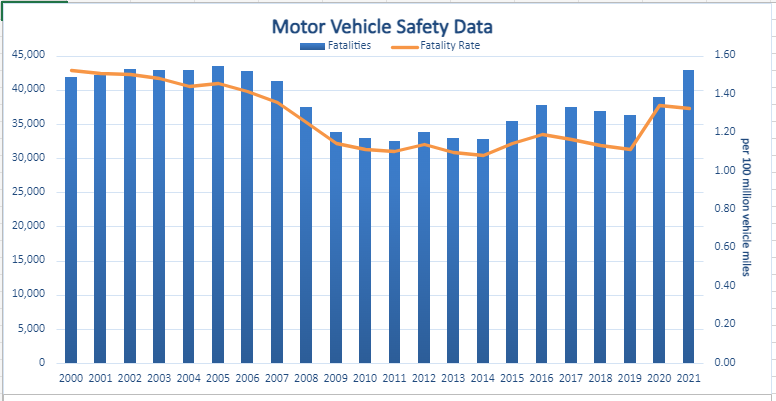

Recent data paints a concerning picture for motorists across the country. The National Highway Traffic Safety Administration’s estimates for 2022 show that roadway fatalities remain consistent, even after two consecutive years of dramatic increases. Specifically, their projections indicate that an alarming 42,795 individuals died in motor vehicle traffic crashes during the year. These statistics highlight the inherent risks associated with driving and emphasize the importance of being prepared for any eventuality.

Image Courtesy: Bureau of Transportation Statistics

But what if the unexpected occurs, and it’s not even you behind the wheel? Discovering that someone else crashed your car can be a deeply unsettling experience. Whether it was a trusted friend, a family member, or an unfamiliar individual, you’re suddenly thrust into a world of stress and uncertainty. Navigating this situation requires a focused approach and understanding the subsequent steps to ensure a seamless resolution. Let’s delve into what you should prioritize immediately after such an incident.

General Benefits of Auto Insurance

In the modern world, where owning a car has become a necessity for many, ensuring it against potential threats is of paramount importance. While some might see auto insurance as just another financial obligation, it offers a plethora of benefits that far outweigh its costs. Not only does it provide a safety net for car owners, but it also ensures peace of mind in the chaotic realm of roads and highways. Let’s delve into some of the most notable advantages of car insurance.

Damage or Loss to Insured Vehicle

One of the primary reasons people invest in car insurance is to safeguard against damages or total loss to their vehicle. Accidents, thefts, fires, or natural calamities—life is unpredictable. Having a comprehensive auto insurance policy ensures that you won’t have to bear the brunt of the financial repercussions in the face of such unfortunate events. Depending on the specifics of your policy, insurance can cover the repair costs or even the vehicle’s replacement value, ensuring that you’re back on the road without significant out-of-pocket expenses.

Personal Accident or Collision Coverage

Safety isn’t just about the vehicle; it’s fundamentally about the people within it. Personal accident coverage is an indispensable component of many auto insurance policies. In the unfortunate event of an accident leading to the death or disability of the policyholder, this cover offers financial support. Such a provision is invaluable, helping families cope with the potential loss of income, medical bills, or other related costs, granting peace of mind to drivers every time they take to the road.

Large Network of Garages

A standout benefit that often goes unnoticed is the vast network of garages with which insurance companies tie up. These affiliations ensure cashless services for insured vehicles. So, if your car requires repairs or maintenance, you can avail services from any network garage without paying a dime upfront. The insurance company settles the bill directly, saving you from the hassle of reimbursement processes and unexpected expenses.

Third-Party Liabilities

Accidents can sometimes result in damages to other vehicles, property, or even injuries to third parties. Here’s where the third-party liability cover comes to the rescue. It protects the car owner from financial liabilities towards the third party for repair costs, medical expenses, or even legal implications. Given the potential high costs associated with such liabilities, this aspect of insurance is crucial, ensuring that an unforeseen event doesn’t lead to crippling financial burdens.

No Claim Bonus

Safe driving has its rewards, quite literally! No Claim Bonus (NCB) is a discount offered to policyholders who do not make any claims during their policy period. It’s an incentive for driving safely and can result in substantial savings on the premium amount during renewals. The NCB can accumulate over the years, leading to sizeable discounts, and underlines the fact that insurance isn’t just about coverage—it can also be about rewards.

How Does My Car Insurance Cover Other Drivers?

At its core, car insurance is designed to protect the policyholder from financial setbacks from vehicular accidents. However, the coverage umbrella often extends beyond just the named policyholder. Many insurance policies inherently cover other drivers who might use the car, though the extent and conditions of this coverage vary widely. Therefore, it’s imperative to familiarize yourself with the specifics of your insurance agreement.

While some policies may offer extensive coverage for other drivers, others might be more restrictive. Generally speaking, if the driver had your explicit or implicit consent to use the vehicle, your insurance might play a primary role in covering damages in case of an accident. Nevertheless, understanding your policy’s intricacies can save you from unforeseen liabilities and complications.

In certain scenarios, the person driving your car might also have an insurance policy. In the event of an accident, there’s potential for their insurance to act as a secondary backup if your policy doesn’t fully cover the damages or injuries sustained. Furthermore, insurance providers typically look at factors such as the frequency of other drivers using your car, their driving records, and your relationship with them (family member vs. friend) when assessing claims involving someone other than the policyholder.

Being well-versed in these nuances ensures you’re not caught off guard as a car owner. Always be transparent with your insurance provider about potential other drivers, and review your policy periodically to ensure it aligns with your current circumstances.

What if Someone Else Drove My Car and Caused the Crash?

Lending your car to a friend or family member might seem harmless. After all, what are the odds something would go wrong? Yet, accidents can happen, and when they do, understanding the ramifications is crucial, especially if someone else was behind the wheel of your vehicle.

Permissive Use

The term “permissive use” encompasses scenarios where the vehicle owner has provided explicit or implicit consent for someone else to drive their car. The car owner’s insurance is the primary coverage when an accident occurs under such circumstances. This means any claims arising from the accident would initially be directed toward the owner’s insurance policy. As a consequence, the owner might have to bear any deductibles, and there’s a possibility of premium hikes in the future.

However, it’s worth noting that “permissive use” does not automatically imply unrestricted coverage. Some policies might have specific clauses or limitations, such as coverage limits or exclusions for certain types of drivers or situations. It’s essential to know these details to avoid surprises.

Non-permissive Use

“Non-permissive use” pertains to an individual using your vehicle without your knowledge or consent. If they subsequently get involved in an accident, your insurance may not cover the damages, as the use was unauthorized. Here, the onus might fall upon the unauthorized driver to bear the costs, either out-of-pocket or through their own insurance if they have any.

It’s crucial to distinguish between non-permissive use and outright theft. If your car was stolen and then involved in a crash, different legal and insurance factors come into play. In either scenario, immediate consultation with authorities and your insurance provider is recommended.

Can the Other Driver’s Car Insurance Become Involved?

The realm of auto insurance is multifaceted, and the involvement of at-fault driver’s insurance is plausible. Specifically, if your own insurance doesn’t fully cover the damages or if the individual was driving your car without permission, their insurance could be summoned to address the financial implications. In scenarios where repair costs surpass your policy’s coverage threshold, the additional amount might be sourced from the other driver’s insurance policy.

However, this isn’t a straightforward process. The specifics of both insurance policies, state laws, and the nature of the accident play pivotal roles in determining the extent of each insurer’s responsibility. As such, seeking advice from insurance experts or legal professionals can be invaluable in navigating these complexities.

What if Your Car Insurance Refuses to Pay for an Accident?

Insurance companies operate based on risk assessment and policy terms. There are circumstances where your insurance provider may deny a claim. Common grounds for refusal include determining whether the driver was under the influence of substances or if the incident occurred during non-permissive vehicle use. When faced with denial, it’s natural to feel overwhelmed and unsure of the next steps.

When confronted with a refusal, it’s crucial not to make hasty decisions. Seek out legal counsel to understand your rights and potential avenues for redress. Depending on the situation, you might need to challenge the insurance company’s decision, or perhaps you could consider seeking compensation directly from the driver responsible for the accident.

How Do You Prove You Permitted Someone to Drive Your Car?

In the world of insurance claims and legal disputes, evidence is paramount. Demonstrating that you had permitted someone to drive your car can sometimes be challenging, especially if it wasn’t granted formally or in writing. Various forms of evidence can be useful, from text messages and emails granting permission to eyewitness accounts or surveillance footage.

Being proactive can also be advantageous. If you regularly allow someone else to drive your vehicle, consider maintaining a written log or even drafting a permission letter. While these measures might seem excessive, they can be instrumental in avoiding prolonged disputes and providing clarity to insurance providers.

What Should You Do After Someone Else Crashes Your Car?

Discovering that someone else crashed your car can be a shocking and disheartening experience. The aftermath can be fraught with stress and uncertainties, whether it is a friend, family member, or even an unknown individual. Navigating this situation requires a calm approach and a clear understanding of the necessary steps to ensure a smooth resolution. Here’s what you should prioritize immediately after such an incident.

Call a Car Accident Attorney

Engaging with the intricacies of law and insurance post-accident can be daunting. To safeguard your interests and navigate the process efficiently, considering professional legal help is prudent. A car accident lawyer can provide guidance tailored to your specific situation, from understanding insurance implications to dealing with potential legal disputes.

Having an experienced lawyer by your side can make a significant difference, ensuring you’re not unjustly burdened with liabilities. They can also aid in negotiations, whether with your own insurance company or the party responsible for the accident, ensuring your rights are protected.

Understand Your Coverage

Post-accident, it’s essential to reassess the breadth and depth of your insurance policy. By familiarizing yourself with its specifics, you clearly understand potential financial obligations, coverage limitations, and any other nuances. This clarity can guide subsequent decisions and interactions with insurance providers.

If the coverage seems insufficient or if you spot areas of ambiguity, it might also be an opportune moment to consider revising or upgrading your policy. Keeping your insurance in sync with your current needs can be instrumental in mitigating future challenges.

Document the Accident

Accurate documentation is the cornerstone of efficient accident resolution. Ensure you capture photographs of the accident scene, damage to the vehicles involved, and any other relevant details. Additionally, collecting contact information from witnesses, obtaining copies of police reports, and maintaining a record of medical or repair expenses can be invaluable for future reference.

A comprehensive set of documents can expedite insurance claim processes and be especially beneficial if any legal disputes arise. Remember, it’s always better to have more documentation than you think you might need, as details can sometimes blur with time.

How Can Moton Legal Group Help?

Navigating the aftermath of a car accident, especially one involving your vehicle but driven by someone else, can be intricate. The Moton Legal Group brings specialized expertise in car accident litigation, offering guidance, representation, and a thorough understanding of the nuances of such situations. With a proven track record, the team can help chart the best course forward, ensuring minimal stress and optimal outcomes.

Drawing from the vast experience, the Moton Legal Group can assist in liaising with insurance companies, handling legal disputes, and ensuring you receive due compensation. Dedication to client welfare and a deep understanding of legal intricacies make them valuable allies in any car accident scenario.

Final Words: What Happens if Someone Else is Driving My Car and Gets in an Accident

Lending your vehicle embodies a profound act of trust. With trust comes responsibility and potential implications. By staying informed about insurance nuances, understanding the legal landscape, and knowing the steps to take if an accident does occur, you position yourself to handle such situations with poise and efficacy. Prioritize safety, clear communication, and seek professional advice when needed. Your car is not just a vehicle but an extension of your life; treat situations involving it with the care and attention they warrant.